Investing in low carbon energy is already the new normal. The lower costs, resilience and environmental benefits means that it is no longer an “alternative” investment.

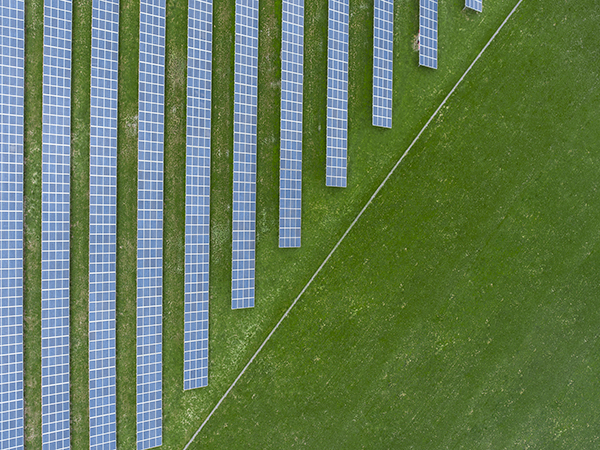

We have invested £1.4 billion into renewable energy infrastructure across the UK, including wind and solar farms. Clean energy generation offers stable long-term returns to secure pension payments far into the future, and by unlocking the power of pensions we can play an important role in tackling climate change.

So, we’ve invested in three offshore wind farms and into renewable energy funds that pay for new projects. And we’re backing companies developing zero carbon fusion and solar energy technology, and installing electric vehicle and low carbon heating infrastructure – our latest investment is in ground source heat pump company Kensa Group.

We're supporting clean energy businesses that already employ more than 400 skilled workers in the UK green economy, and we expect further accelerated growth in employment in the sector as the UK invests for the future post Covid-19 where tackling climate change should dominate the agenda.

John Bromley, Head of Clean Energy, says: "We are deploying our capital to accelerate the UK’s progression to a low-cost, low-carbon economy. Our clean energy investments, which include low carbon heat, transport and power generation, will play an essential part in the UK’s solution for reaching net zero carbon emissions by 2050."